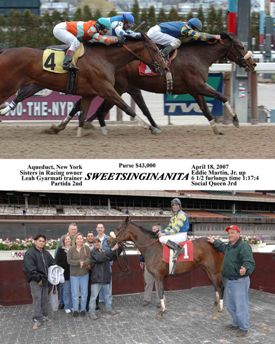

Making thoroughbred ownership a reality...for you

|

|

Minimum Investment: The minimum investment required for participation in a Sisters in Racing Thoroughbred will vary depending on the purchase price of the horse and initial acquisition expenses. To view our current offerings just go to that link. To view our entire stable click on Our Stable link. Contact us for more information Minimum Investment: The minimum investment required for participation in a Sisters in Racing Thoroughbred will vary depending on the purchase price of the horse and initial acquisition expenses. To view our current offerings just go to that link. To view our entire stable click on Our Stable link. Contact us for more information

Monthly Fees: The monthly fees include training, stable supplies, veterinarian and blacksmith fees, transportation and administrative expenses. One big difference between Sisters and other partnerships is that we never mark up expenses! Most partnerships mark up all expenses as much as 50% above original costs. With Sisters in Racing what we pay is what you pay.

Owner Licenses: Members who own more than 3% of a thoroughbred must obtain a valid owner's license.

Tax Benefits: Losses incurred by an LLC member are treated as ordinary losses if the LLC member materially participates in the business of the LLC. Each LLC member is strongly encouraged to consult with their personal tax advisor to determine whether she has met the material participation standard.

Insurance and Liability: Sisters in Racing has general liability insurance policies, however it is up to the individual investor as to whether or not they want to purchase mortality insurance on their shares. We are happy to facilitate an appropriate policy for our clients. As an LLC, Sisters in Racing acts as the racing manager and limits the liability of the members in case of a lawsuit solely to the assets of the partnership, so our members are not personally liable or at risk for the entire cost of the horse. |

|